After you get yourself a credit-builder loan, the lender will typically deposit the financial loan sum right into a committed account as an alternative to supplying you with the cash. You then start making payments. After the financial loan is paid off, you’ll get the funds.

A cash advance is once you make use of your credit card to get cash, like from an ATM or financial institution department. But you can find Other folks kinds of transactions which might be also viewed as cash advances, for instance utilizing your bank card to: transfer funds to buddies working with applications like PayPal, Venmo or Moneygram, fork out a personal debt (for instance a car or truck personal loan) employing a third-celebration bill pay company, obtain On line casino chips or lottery tickets, or exchange dollars for foreign currency.

Chime is often a cell banking application that gives a number of attributes for getting income to you personally quicker. It’s crucial that you note that Chime is actually a financial know-how company, not a bank.

Investigate far more vehicle insurance plan resourcesCompare car insurance policies ratesBest vehicle insurance coverage companiesCheapest car insurance plan companiesCar insurance plan reviewsAuto insurance plan calculator

Merchant cash advances extend resources to tiny business people dependant on earlier revenue plus a projection of upcoming revenue.

Could be less costly than an overdraft payment: Should your selection is amongst a paycheck advance and having to pay an overdraft rate, the advance is likely much less expensive. here Quite a few app service fees is often beneath $ten (with no idea), whilst bank overdraft service fees could be approximately $35.

Take into account that your credit history cash advance line is frequently a minimal proportion of your overall credit history line and that interest rates commence accruing immediately.

Financial loans might be difficult. Some financial loan providers will operate credit score experiences, which implies they won't acknowledge your application on your $600 bank loan with bad credit rating. But there’s no will need to start out stressing! You will discover other $600 financial loan selections for many who could have decrease credit scores.

Once you submit an application for a $600 personal loan at Advance The united states, there’s no impression to the FICO credit score rating. Based on the lender you end up picking, a $600 mortgage may possibly affect your credit rating, particularly when you fail to repay the mortgage by the due date.

Pay off cash advances designed employing a charge card immediately. The best way to pay off a cash advance is by having to pay the lender on precisely the same working day the withdrawal was designed since cash advances accrue interest the identical day a transaction is produced. Payment is typically made exactly the same way you'd Typically pay out down a credit card equilibrium.

Be sure to Take note that not all personal loan solutions, savings products, or lenders are represented on our website. Financial loans for Credit history Underneath 600

Borrowing from anyone you belief, like an acquaintance or loved one, might get you the money you need without the need of purple tape or threat for your funds. You can even attract up a agreement that particulars repayment conditions and fascination.

Some states allow lenders to roll more than or renew financial loans if the borrower cannot repay the personal loan moreover service fees in whole.

Aside from house loan personal loan offers, this compensation is one of a number of aspects which could affect how and where by features surface on Credit history Karma (together with, for example, the order by which they seem).

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Barret Oliver Then & Now!

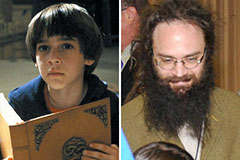

Barret Oliver Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now!